oregon college savings plan tax deduction 2018

Answer Simple Questions About Your Life And We Do The Rest. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Citizens to invest in their childrens educational future by starting out with as little as 25.

. Learn More About the Nations Largest 529 College Savings Plan. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. File Late Taxes Today With Our Maximum Refund Guarantee.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. File With Confidence Today.

The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Find Out if a 529 Plan is Right for You. This article will explain the tax deduction rules.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The Oregon College Savings Plan allows US.

Ad Find Out if a 529 Plan is Right for Your College Saving Needs. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Parents and students invest in 529s and if the.

Answer Simple Questions About Your Life And We Do The Rest. Oregon 529 College Savings Plan withdrawals. No Tax Knowledge Needed.

Traditional college savings plans known as 529 accounts have offered an incentive for families to save for college. No Tax Knowledge Needed. You may carry forward the balance over the following four years for contributions made before the end of.

Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint. OR-A to itemize for Oregon. Ad Tax-Advantaged College Savings Plan With Low Fees From American Funds.

If you withdrew funds from an Oregon 529 College Savings Network plan for the enrollment or attendance at an ele - mentary. Families who invest in 529 plans may be eligible for tax deductions. Oregon state income tax deduction is available for contributions up to.

Beginning on Jan. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. A 529 plan can be a great alternative to a private student loan.

Learn More at AARP. All Available Prior Years. Keep records with your tax file.

With the Oregon College Savings Plan your account can grow with ease. 1 2018 the state income tax deduction for contributions made to a CollegeAdvantage 529 plan doubles from 2000 to 4000 per beneficiary per year. Afterward they can contribute up to 400000.

File With Confidence Today. Ad Free prior year federal preparation Prepare your 2018 state tax 1799. Contact a Fidelity Advisor.

This federal deduction from adjusted gross income AGI was suspended for tax years 2018 through 2025.

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

How Much Can You Contribute To A 529 Plan In 2021

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

529 Plan Deductions And Credits By State Julie Jason

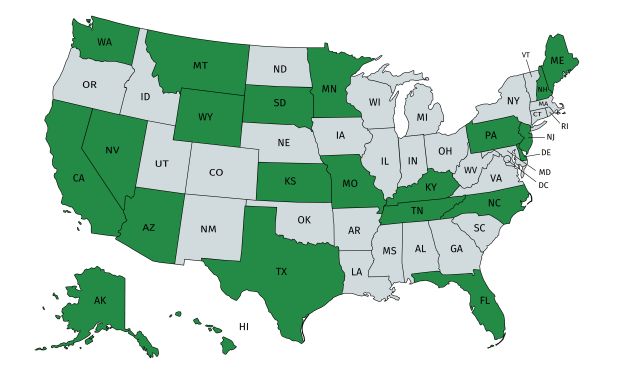

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

How To Save For College Quickly H R Block

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

New York 529 Plans Learn The Basics Get 30 Free For College Savings

Can I Use A 529 Plan For K 12 Expenses Edchoice

Can I Use My Account To Pay For Room And Board Expenses Oregon College Savings Plan

529 Plan Advertisements And Marketing Collateral

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Gifting Faqs Oregon College Savings Plan

Using A 529 Plan From Another State Or Your Home State